Many US businesses are eligible to deduct equipment purchases made before December 31 under Section 179. Learn how a Clarius handheld scanner can qualify and reduce your tax bill this year.

See the Potential Savings

| Scanner Price: | $4,190.00 |

| Deduction Applied: | $4,190.00 |

| Tax Savings* (assuming 24% tax bracket): | $1,005.60 |

| Equipment Cost After-Tax Savings: | $3,184.40 |

* Example only. Actual savings depend on individual tax circumstances. Please consult your tax advisor.

Section 179 of the IRS tax code allows many businesses to deduct the cost of qualifying equipment in the year it is purchased and placed into service. Instead of depreciating over several years, you may be able to accelerate the deduction this year. This includes portable medical devices such as Clarius handheld ultrasound scanners when purchased and activated by December 31. 2025.

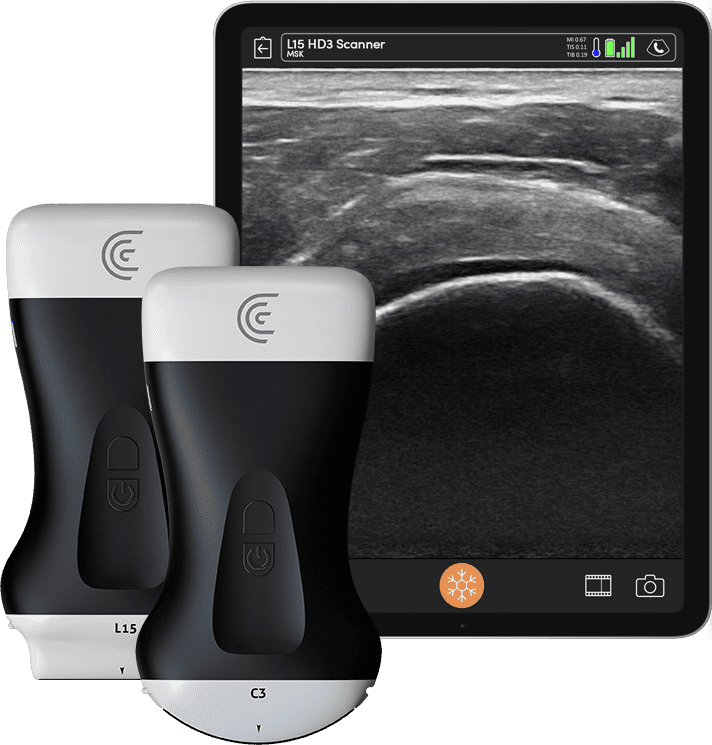

MSK Bundle

Get everything you need for confident MSK imaging, including two scanners and a 3-year membership.

Primary Care bundle

A complete POCUS solution for Primary Care, combining versatile imaging tools with a 3-year membership.

OB/GYN Bundle

Comprehensive, wireless ultrasound capabilities for women’s health with a 3-year membership.

Request Bundle Pricing

Get A Quote

Powered by AI with specialized presets and customizable workflows, Clarius HD3 automatically optimizes imaging to deliver a superior ultrasound experience. Our versatile wireless ultrasound lineup ensures there’s a perfect fit for every specialty. Speak with an expert to discover the ideal solution for your practice.

We’re Here To Help

Whether you’re looking for a specific solution or need help finding the right scanner for your practice, we’re here to help. Get in touch with us and let’s get started!

We’re Here To Help

Whether you’re looking for a specific solution or need help finding the right scanner for your practice, we’re here to help. Get in touch with us and let’s get started!

By providing my email, I consent to receive Clarius webinar invitations, case studies, whitepapers, and more, and I consent to the Clarius Privacy Policy. I can unsubscribe anytime.